-

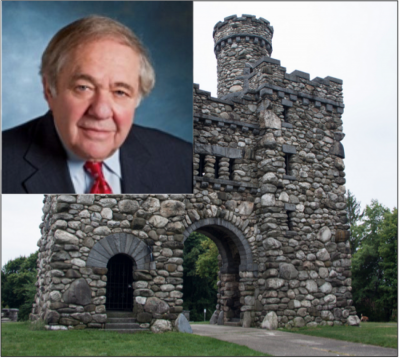

#25

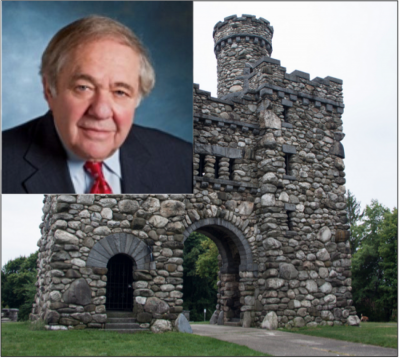

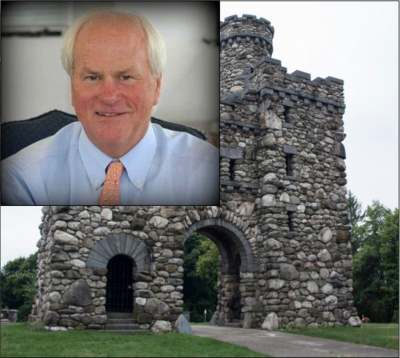

Mel Cutler - CIO and Founder of Cutler Capital Management

Not only did Cutler found Cutler Capital Management, but he also is the founder of two banks - Flagship Bank & Trust and Madison Banc Shares.

Cutler Capital Management has $325 million in assets.The Melvin S. Cutler Charitable Foundation has more than $8 million in assets. He has been influential in business and in philanthropy for decades.

-

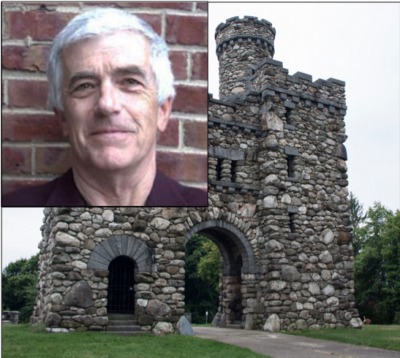

#24

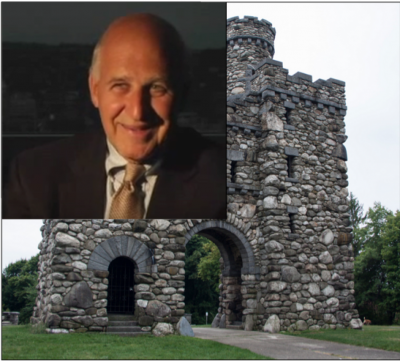

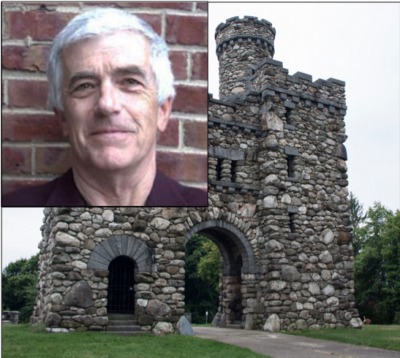

Bernie Rotman, Rotman's Furniture

Rotman has been in the family business for 35 years - with Rotman's Furniture in College Square - a landmark next to I-290.

He and his brother Barry have been running the business taking over for their parents Murray and Ida.

In the 1990's, Rotman's Furniture seemed like it was the only furniture store. In the day they dominated advertising - their TV spots ran in Providence and Boston markets. Today, with Bob's and Jordan's in the market it is a lot more competitive.

In the early 1990s, Rotman’s partnered with the Central Mass Housing Authority (CMHA) to work with Donations Clearinghouse to donate used furniture to families in need. The family has been a major supporter for Walk for Homeless.

-

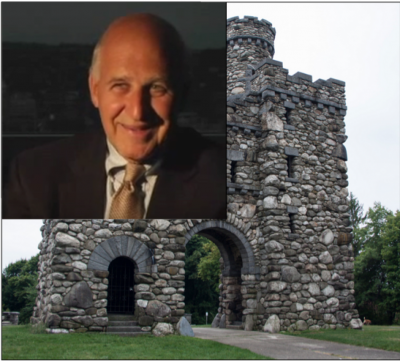

#23

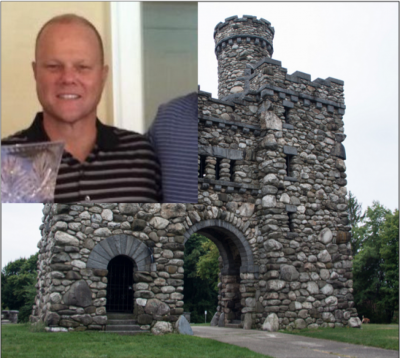

Charles and Janet Birbira - Owners of Beechwood Hotel

In 2015, the Birbiras invested in a multi-million dollar renovation of the Beechwood Hotel to make it more luxurious and upscale.

It’s already the most luxurious in Worcester - they’re aiming for the entirety of the remaining state west of Boston.

The Ceres Bistro cost was $9 million to add to the hotel back in 2010.

-

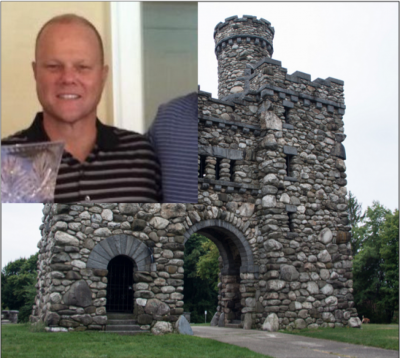

#22

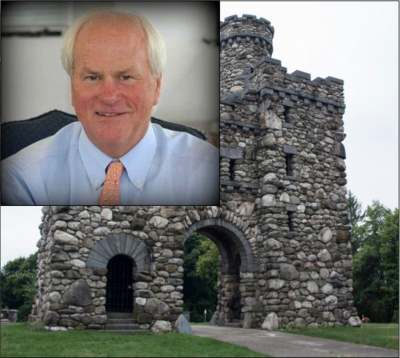

J. Robert Seder - Lawyer

In 2014, Seder was named the Worcester Corporate Lawyer of the Year. He was also named in 2014 as one of the Best Lawyers in America for Bankruptcy and Creditor Debtor Rights/Insolvency and Reorginzation Law.

He owns property in Worcester totaling nearly $6 million.

A partner at Seder & Chandler Law, Seder is also the former chair of the Worcester Business Development Corporation.

-

#21

David Fields - Managing Partner, Wormtown Brewery

Former owner of Consolidated Beverages, Fields recently sold the company (which he and his father spent millions on ten years ago) to Quality Beverage.

Fields now solely focuses on Wormtown Brewery which just opened on Shrewsbury Street in March. Fields owns majority interest in the company - using the millions he made in the Consolidated Beverages sale to invest into Wormtown.

Fields is one of the youngest on the GoLocalWorcester list of the 25 Wealthiest and Most Influential.

-

#20

Sue Mailman - President and CEO of Coghlin Electric

President and Owner of Coghlin Electric, Mailman is arguably the most talented businesswoman in Central Massachusetts. Mailman serves on a range of community focused boards and is the Chair of the Worcester Regional Chamber of Commerce Board.

Mailman is savvy and responsible for a business that is now part of WESCO Distribution, Inc. - a $3 billion concern.

She is the 4th generation leader of a company over 130 years old.

-

#19

Tony Tilton - Director of Fletcher Tilton Law Firm

With roots in Worcester dating back 190 years, Fletcher Tilton is the 9th oldest law firm in the nation and is one of only five of the top 50 law firms in Massachusetts not located in Boston.

The firm is responsible for multiple private trusts and foundations, and Director Tony Tilton oversees 20 private family foundations and handles nearly a half a billion dollars in assets.

In Worcester, if any charity is seeking donations - they typically have to go through Tilton. He and his partner, Warner Fletcher, decide where most of the charitable money in the city goes.

He is enormously responsible for raising the $7.5 million for the new Boys and Girls Club clubhouse nearly 10 years ago. Tilton is also Treasurer of Cape Cod Healthcare.

He has honorary degrees from both Clark and Assumption.

-

#18

Mark Fuller - Chairman of THE GEORGE F. and SYBIL H. FULLER FOUNDATION

At the end of last year, the Fuller Foundation had assets of nearly $55 million. The foundation awarded more than $3.6 million in grants ($2.9 of which went to 69 capital grants to local colleges and organizations).

Fuller is also Vice President of Benefit Development Group in Worcester and Treasurer of the Barton Center for Diabetes Education.

Prolific in his energy and focus to serving the community.

-

#17

John Spillane - Attorney at Spillane and Spillane, LLC

Spillane’s father earned $55.6 million in payout in 2007 following the sale of Commerce Group, Inc. in 2007 to the Spanish firm Mapfre SA.

Commerce’s specialty is providing insurance through the AAA’s 100 million members.

Spillane is an attorney at Spillane and Spillane, LLC at the Worcester office. He served as co-chair of the United Way' campaign in 2013.

-

#16

Mary DeFeudis - Philanthropist

DeFeudis sits on the Hanover Theatre board of directors and was instrumental in raising the $31 million needed to renovate the theatre. DeFeudis also contributed $1 million to the Hanover Theatre project.

DeFeudis is the Chairwoman of Worcester Sharks Charities and a member of the UMass Medicine Development Council.

DeFeudis has provided a full scholarship annually to a student at Worcester State University.

She may be the community's most active philanthropist.

-

#15

Frank Carroll - Businessman

Frank Carroll founded the Small Business Service Bureau in the 1960s, a company designed to help and advocate for small businesses across the country. SBSB has grown into one of the largest small business groups in America.

Carrol's been helping people in Worcester ever since.

Carroll raised $1 million to build a Korean War Memorial in Worcester and was instrumental in the building of a hospital for American soldiers from Worcester County in Vietnam.

Carroll hosts a show at the Hanover Theatre to raise money for the St. John's Church Food for the Poor Program.

-

#14

David R. Grenon - E-C Realty President

Grenon scored $22.5 million in profit shares following the sale of Commerce Group, Inc. to MapFre in 2006. Grenon serves on the Board of Trustees for Massachusetts Biomedical Initiative. He is also a Trustee of Assumption College.

Grenon is the President of E-C Realty Corporation. Previously, he was the founder, President and CEO of Protector Group Insurance Agency - which was sold three years ago with annual revenues of $13.6 million.

Grenon runs a charitable trust in his name that holds $312,864 in assets.

-

#13

Neil McDonough - President and CEO of FLEXcon

McDonough and his family have run FLEXcon for 60 years and the manufacturer of pressure-sensitive films and adhesives has grown to be a mega company.

The global firm employs a reported 1,300 employees around the world. The private company has gotten more active in Worcester - with community sponsorships and earlier this summer, McDonough spoke at the DCU Center as part of the Worcester Research Bureau’s Acting Locally Panel.

in 2009, McDonough was named the Worcester Business Journal's Big Business Leader of the Year.

However, the company’s reach is global with manufacturing and sales offices on nearly every continent on the globe.

-

#12

Joe Salois - CEO, Atlas Distributing

Salois is President and CEO of Atlas Distributing in Auburn. He serves as the Director of Fidelity Bank and is a Trustee of Saint Vincent’s Hospital.

Speaking of influential, Salois was named to Governor Charlie Baker’s Economic Transition Team last December and Atlas played host to a Central Mass Delegation of Senators and State Reps in March.

He has a big impact on business, government and the community.

-

#11

Mike Angelini - Chairman of Bowditch & Dewey

Angelini is known to be a lawyer's lawyer. He was named one of the 2015 Best Lawyers in America by Best Lawyers, Angelini is known as one the nicest and down-to-earth guys in Worcester.

Angelini serves on the board at MassPort and is chairman of the board of Hanover Insurance. He, along with Sue Mailman of Coghlin Electric and Becker College President Robert Johnson, were instrumental in re-recruiting Ed Augustus to be City Manager in Worcester.

With Angelini at the helm of the firm, Bowditch & Dewey has been able to both expand the firm’s Boston presence and continue to prosper in Worcester.

-

#10

Regan Remillard - Haven Country Club

Another big winner in the sale of Commerce lands on GoLocalWorcester's Wealthiest and Most Influential - the son of a prominent business owner who achieved success in his own right.

As the Boston Globe reported at the time of the Commerce sale, “Arthur J. Remillard Jr., who ran the company until his retirement in July 2006, will be paid $26 million for his 710,000 shares, while his children, Arthur III and Regan, will receive $43.6 million and $15.9 million, respectively. Arthur III and Regan are both members of the Commerce board.”

In 2012, the younger Remillard purchased the Haven Country Club in Boylston (formerly Mount Pleasant Country Club). At the time of the rebranding of the golf course, Regan issued a forward-looking statement, “I see this as a club whose star is rising. We’ve taken the traditional country club model and updated it a bit, to better fit the way people live today … A club should be someplace where you can have fun and feel at home. That’s the vision here.”

The Regan Remillard foundation has more than $500K in assets - while the Remillard Family Foundation has nearly $2 million.

-

#9

M. Howard Jacobson - Vice Chairman of WGBH Educational Foundation Inc

Jacobson serves as the Chair of the Board for the Boston Market Corporation and the Wyman-Gordon Company. He is the Vice Chairman of WGBH Educational Foundation Inc. and a Trustee of WPI.

Jacobson served as Senior Advisor and Consultant at Private Advisory Services of Bankers Trust Private Bank from 1991 to 2001.

Prior, he served as the President and Treasurer of Idle Wild Foods, Inc. until 1986.

Like many on this list, he is also on the UMass Medicine Development Council.

-

#8

Valentin Gapontsev - Fiber Optics

There are people who are wealthy on this list and then there is Gapontsev.

Gapontsev, the father of the fiber-optic laser industry, is the only billionaire on this list because he's the only billionaire in Central Massachusetts. Thanks to lasers, his net worth is $1.24 billion.

This genius Russian and Worcester resident is the founder of IPG Photonics - located in the town of Oxford.

According to Forbes Magazine, he is #1533 on the Forbes Billionaire list globally.

-

#7

Ralph Crowley Jr - CEO of Polar Beverages

Crowley runs Polar Beverages - a foundation in Worcester and a company the city is proud to hang its hat on. Polar Beverages is valued at nearly $500 million and Crowley is largely responsible for it. He's modernized the Seltzer water industry with numerous flavors and engages his customers to perfection.

Crowley made an attempt to purchase the T&G in 2009, but was snubbed by New York Times - who sold it to John Henry (who sold it again within months). The Crowley family also owns Wachusett Mountain and the nearby Wachusett Village Inn.

EDITOR'S NOTE - We previously published a photo of Chris Rowley rather than Ralph. This has been corrected and we apologize for the error.

-

#6

Robert Branca - Developer and Food Services

Branca is a philanthropist, developer and Dunkin’ Donuts mogul.

He is a national leader in the Dunkin’ franchise structure

In Branca's family, nearly 700 Dunkin Donuts are owned - with him owning 60 DD franchises.

Branca is the Chairman of the Dunkin' Donuts Franchise Owners Political Action Committee and Chairman of the Dunkin' Donuts Regional Advisory Council of all Dunkin' Donuts franchisees in the Northeastern U.S., and is the Vice Chairman of the Washington-DC based Coalition of Franchisee Associations.

Branca's company owns 72 and 60 Shrewsbury Street - the home of Volturno, Sweet and Wormtown Brewery.

Together, both buildings are valued at more than $3 million.

-

#5

Barry Krock - Real Estate

The DCU Center (former Worcester Centrum) was nearly named the Krock Arena. The Krocks have been a power in banking and real estate in the city for decades.

The Krock family owns 11 pieces of property in Worcester (worth multiple millions) including three parking lots across from the Worcester Courthouse and the building that formerly housed the Irish Times (worth $1.5 million total between the three lots and building).

Krock used to own the Commerce Bank Building before he sold the building for $4.5 million to David “Duddie” Massad in 2010 - for $400,000 less than its estimated value - after turning down offers of $21 million, $11 million, and $10 million.

For one perspective on the Krock family, check out Unlocking the Krocks.

-

#4

Allen Fletcher - President of the Greater Worcester Land Trust

Up until 2008, Fletcher owned Worcester Magazine — once a top level alternative weekly newspaper. He, along with his brother Warner, inherited a tremendous wealth and he's utilized that money to make his own impression on Worcester.

Fletcher's money is part of what's behind the Canal District revitalization and he serves as the President of the Greater Worcester Land Trust - a non-profit organization that serves to protect the land of Worcester.

-

#3

Warner Fletcher - Director of Fletcher Tilton

Fletcher maybe the most influential person in philanthropy in Central Mass.

Fletcher is the chairman of three charitable trusts in Worcester - including the two largest - George I Alden Trust, Stoddard Charitable Trust and Fletcher Foundation.

Last year alone, the Alden Trust gave $9.5 million in charitable donations - including a $3 million future payable donation to WPI. The Stoddard Trust has more than $70 million in assets and gave more than $3.5 million last year in charitable donations.

Fletcher, along with #6 on this list, Tony Tilton, run Fletcher Tilton Law Firm - which oversees 20 private family foundations and handles nearly a half a billion dollars in assets.

-

#2

David "Duddie" Massad - Chairman of Commerce Bank

A Grafton Hill product, Massad owned several car dealerships including Diamond Auto Group, Emerald Chevrolet Oldsmobile, Duddie Motors and the largest Hertz franchise in Virginia Beach, Virginia.

Massad serves as the Chairman of Commerce Bank in Worcester - a company he purchased from the Krock family - that has over $1.7 billion in assets and 250 employees according to the bank.

In 2005, he donated $12.5 million for a new medical facility at UMass Memorial Medical Center's Lake Avenue campus.

He was indicted for fraud in 2008 - but was ultimately proven innocent.

-

#1

Fred Eppinger - CEO and President of Hanover Insurance

Eppinger may be the most able chief executive in central Massachusetts. His leadership in growing Hanover Insurance and his activism in the community is unmatched.

The company is trading 33% higher in the past year.

Eppinger, a Holy Cross graduate, made more than $5 million in compensation in 2014 as CEO and President of Hanover Insurance.

Eppinger also has $28 million in options through Hanover. Eppinger has been with Hanover since 2003 - when it was called Allmerica and had lost $306 million. Since then, Eppinger has turned Hanover around as a business and the company has donated millions towards the Hanover Theatre, Hanover Field, and UMass Memorial.

He oversees more than 5,000 employees.

To appreciate the full breadth of possibility created by emerging technologies is to feel like a kid in a candy store. Our candy store is overflowing with brain-exploding and exciting new technologies including genomics, robotics, internet-of-things, big data, artificial intelligence, drones, and 3D printing to name just a few.

To appreciate the full breadth of possibility created by emerging technologies is to feel like a kid in a candy store. Our candy store is overflowing with brain-exploding and exciting new technologies including genomics, robotics, internet-of-things, big data, artificial intelligence, drones, and 3D printing to name just a few. Saul Kaplan is the Founder and Chief Catalyst of the Business Innovation Factory (BIF). Saul shares innovation musings on his blog at It’s Saul Connected and on Twitter at @skap5.

Saul Kaplan is the Founder and Chief Catalyst of the Business Innovation Factory (BIF). Saul shares innovation musings on his blog at It’s Saul Connected and on Twitter at @skap5.

Delivered Free Every

Delivered Free Every